Why traders still pick MT4 over newer platforms

MetaQuotes stopped issuing new MT4 licences some time ago, steering brokers toward MT5. Yet most retail forex traders stayed put. The reason is not complicated: MT4 has twenty years of muscle memory behind it. A huge library of custom indicators, Expert Advisors, and community scripts run on MT4. Migrating to MT5 means porting that entire library, and few people don't see the point.

I've tested MT4 and MT5 side by side, and the gap is smaller than you'd expect. MT5 has a few extras like more timeframes and a built-in economic calendar, but the charting feels very similar. For most retail strategies, there's no compelling reason to switch.

Getting MT4 configured properly the first time

The install process is quick. What actually causes problems is configuration. Out of the box, MT4 loads with four charts squeezed onto one window. Clear the lot and start fresh with the pairs you care about.

Templates are worth setting up early. Build your go-to indicators on one chart, then save it as a template. From there you can apply it to any new chart instantly. Minor detail, but over months it adds up.

One setting worth changing: go to Tools > Options > Charts and tick "Show ask line." The default view is the bid price on the chart, which makes your entries look off by the spread amount.

MT4 strategy tester: honest expectations

The strategy tester in MT4 gives you the ability to run Expert Advisors against historical data. Worth noting though: the reliability of those results depends entirely on your tick data. Built-in history data from MetaQuotes is modelled, meaning it fills in missing ticks using algorithms. If you're testing something more precise than a quick look, grab proper historical data.

That quality percentage in the results is more important than the headline profit number. If it's under 90% suggests the results aren't trustworthy. People occasionally show off backtests with 25% modelling quality and can't figure out why the EA fails in real conditions.

Backtesting is where MT4 earns its reputation, but the output is only useful with quality tick data.

Building your own MT4 indicators

MT4 comes with 30 default technical indicators. The average trader uses maybe a handful. However the platform's actual strength lives in user-built indicators built with MQL4. You can find thousands available, ranging from simple moving average variations to elaborate signal panels.

The install process is painless: copy the .ex4 or .mq4 file into your MQL4/Indicators folder, restart MT4, and you'll find it in the Navigator panel. The catch is quality. Publicly shared indicators range from excellent read this article to broken. A few are solid tools. Many stopped working years ago and will crash your terminal.

If you're downloading custom indicators, check how recently it was maintained and if users report issues. A poorly written indicator won't just give wrong signals — it can freeze your entire platform.

The MT4 risk controls you're probably not using

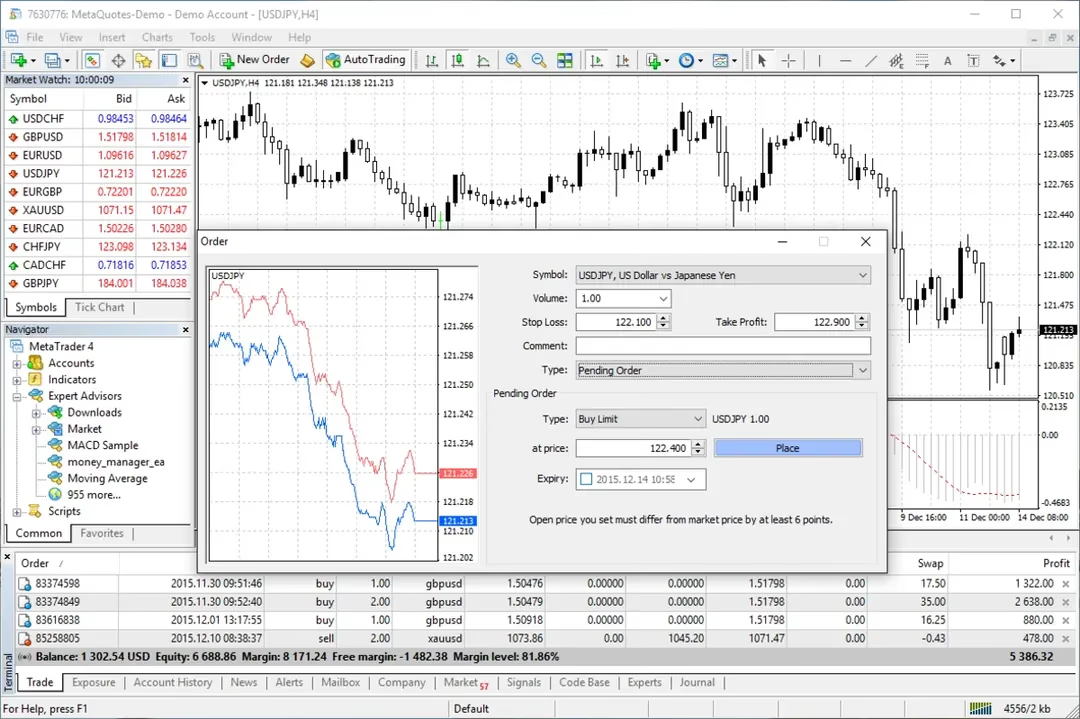

MT4 has a few native risk management features that the majority of users skip over. Probably the most practical one is the maximum deviation setting in the order window. This defines how much slippage you'll accept on market orders. If you don't set it and you'll get whatever price the broker gives you.

Everyone knows about stop losses, but MT4's trailing stop feature are overlooked. Click on an open trade, select Trailing Stop, and enter the pip amount. The stop follows automatically as the trade goes into profit. Doesn't work well in choppy markets, but if you're riding trends it reduces the need to stare at the screen.

You can configure all of this in under five minutes and they take some of the guesswork out of trade management.

Expert Advisors — before you trust a robot with your money

EAs attract traders for obvious reasons: define your rules and let the machine execute. In reality, most EAs lose money over any meaningful time period. EAs marketed using incredible historical results tend to be curve-fitted — they worked on past prices and break down the moment conditions shift.

This isn't to say all EAs are useless. Certain traders build personal EAs to handle specific, narrow tasks: opening trades at session opens, managing position sizing, or exiting positions at fixed levels. That kind of automation work because they do defined operations where you don't need interpretation.

When looking at Expert Advisors, use a demo account for a minimum of two to three months. Forward testing reveals more than historical results ever will.

MT4 beyond the desktop

MT4 is a Windows application at heart. If you're on macOS face compromises. Previously was emulation, which mostly worked but had rendering issues and the odd crash. Some brokers now offer macOS versions using compatibility layers, which work more smoothly but still aren't built from scratch for Mac.

MT4 mobile, on both iOS and Android, are surprisingly capable for monitoring your account and tweaking stops. Full analysis on a phone screen is pushing it, but managing exits while away from your desk has saved plenty of traders.

It's worth confirming if your broker provides real Mac support or a compatibility layer — it makes a real difference day to day.